Danelfin

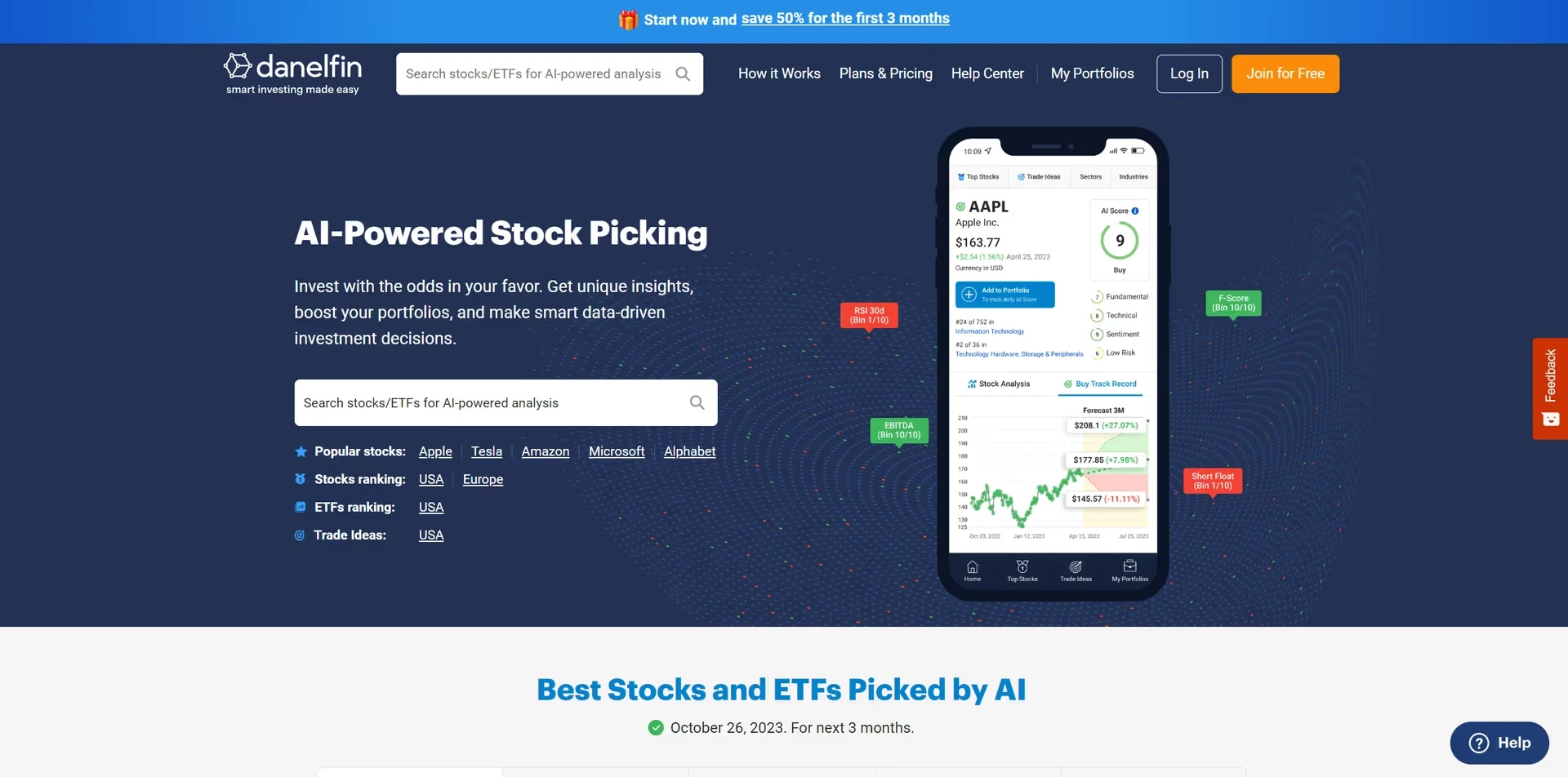

AI Finance ToolsDanelfin is an AI stock analytics platform designed to help investors make smarter, data-driven investment decisions. By leveraging the power of AI-powered investment tools, Danelfin analyzes vast amounts of stock market data, providing users with insightful predictions and unique perspectives on stock performance. With its advanced AI engine, Danelfin processes over 600 technical indicators, 150 fundamental metrics, and 150 sentiment-based factors for each stock, generating more than 10,000 daily features that investors can use to their advantage. This powerful platform is built to cater to both individual investors and institutional traders who are looking to maximize their portfolios with precision and intelligence. Danelfin doesn't just analyze historical data; it continuously monitors market trends in real time, allowing investors to identify opportunities quickly. The platform’s AI score, which ranks stocks based on performance, gives a clear snapshot of a stock’s potential, making data-driven investment strategies easier to implement.

Key Features

AI Stock Scoring System: Danelfin uses artificial intelligence to score stocks based on multiple factors like technical, fundamental, and sentiment data. Each stock receives an AI score to help investors quickly assess whether it is worth buying or holding.

Comprehensive Data Analysis: The tool processes more than 900 daily indicators for each stock. This includes data like price movements, trading volume, financial reports, and market sentiment, enabling accurate stock predictions and insights.

Portfolio Performance Monitoring: This AI stock analytics tool allows users to monitor their portfolios in real-time, providing updates on stock performance and identifying areas where adjustments could lead to better returns.

Stock Market Prediction Software: By analyzing billions of data points, Danelfin helps users predict stock market movements, enabling smarter investment decisions with fewer risks.

Custom Investment Strategies: The platform offers insights tailored to different types of investors, whether you're interested in short-term trading or long-term growth strategies. Users can optimize their portfolios based on personalized data and AI-powered investment tools.

How Does Danelfin Help You?

Danelfin helps investors streamline their decision-making process by providing comprehensive, data-driven stock analytics. The platform processes an enormous amount of information, so users don’t have to manually analyze multiple factors that affect stock prices.

Whether you are looking to predict the future movement of a stock or simply monitor the performance of your investment portfolio, Danelfin’s AI-powered approach offers a reliable and time-saving solution. Its data-driven investment strategies and real-time monitoring capabilities enable you to stay ahead of market trends and make better-informed investment choices.

Pros

Data-Driven Insights: Danelfin’s AI processes billions of data points, making it one of the most comprehensive AI-powered investment tools on the market. It delivers actionable insights that help investors optimize their portfolios with confidence.

User-Friendly Interface: Despite the complex analytics, Danelfin’s interface is intuitive and easy to navigate, catering to both beginners and professional traders.

Real-Time Updates: Get real-time stock analysis and portfolio performance monitoring, enabling you to react swiftly to market changes.

Personalized Investment Strategies: The platform provides tailored strategies based on your financial goals, risk tolerance, and market preferences.

Risk Mitigation: By providing early warning indicators, Danelfin helps users minimize risks by identifying stocks that may perform poorly in the near future.

Enhanced User Confidence: Danelfin empowers users by offering a transparent approach to its AI processes. This clarity allows investors to trust the data they receive and understand how it influences stock recommendations. The platform provides detailed explanations of its AI scoring system, which helps users interpret complex analytics with confidence.

Cons

Learning Curve for Beginners: While the platform is user-friendly, new investors might take time to fully understand all the indicators and how to use them effectively.

Limited Free Features: Advanced features like in-depth analysis and stock predictions are usually locked behind a paywall, requiring a subscription to access the full potential of the tool.

Overwhelming Data: For investors not accustomed to working with large amounts of data, the comprehensive nature of Danelfin’s analytics may feel overwhelming at first.

Geographic Limitation: Danelfin currently focuses on US and STOXX Europe 600 stocks, which might not meet the needs of investors looking to trade in other global markets.

Pricing

• Free Plan: $0/month

• Plus Plan: $25/month ($19/month when billed annually)

• Pro Plan: $70/month ($52/month when billed annually)

FAQs

1. What is Danelfin, and how does it use AI for stock picking?

Danelfin is an AI-powered stock analytics platform that uses advanced machine learning to analyze over 600 technical, 150 fundamental, and 150 sentiment indicators per stock. It provides unique insights to help investors make data-driven decisions.

2. How does Danelfin’s AI stock scoring system work?

Danelfin's AI stock scoring system calculates a proprietary AI Score by analyzing over 900 daily indicators and more than 10,000 features per stock, allowing users to assess stock performance and predict market trends.

3. Can Danelfin predict stock market trends?

Yes, Danelfin uses AI-powered investment tools to identify market trends, analyze data, and make predictions based on a variety of factors, improving the accuracy of stock market forecasts.

4. What types of stocks does Danelfin support?

Currently, Danelfin focuses on US stocks and STOXX Europe 600 stocks, making it an ideal platform for investors looking to invest in these markets.

5. Is Danelfin suitable for global investors?

While Danelfin primarily covers US and STOXX Europe 600 stocks, it may not support other global markets, limiting options for international investors outside these regions.

6. Does Danelfin provide real-time data for portfolio performance monitoring?

Yes, Danelfin offers real-time data monitoring for portfolio performance, allowing investors to track their investments and make informed decisions using AI-powered insights.

7. How does Danelfin help with data-driven investment strategies?

Danelfin assists investors in creating data-driven strategies by analyzing extensive historical and real-time stock data, which can be used to identify high-performing stocks and manage risk.

8. Is Danelfin easy to use for beginners?

Danelfin offers a user-friendly interface and provides valuable insights, making it accessible for both novice and experienced investors looking to leverage AI for stock market predictions.

9. What is the cost of using Danelfin's AI stock analytics?

Danelfin offers different pricing plans, including a free tier with basic functionalities and paid options with advanced features for AI-powered stock analysis.